Master of Quantitative Finance

Master of Quantitative Finance

Launch a Dynamic Career in Quantitative Finance

Full-Time, In-Person Program at UMD's College Park Campus

The Robert H. Smith School of Business Master of Quantitative Finance (MQF) program leverages AI in preparing you to enter the evolving financial services industry. In this program, you’ll gain specialized knowledge of financial markets and institutions while further developing your coding and machine learning skills. Our MQF students are methodical problem solvers who are highly proficient in mathematics, coding and other quantitative subject areas.

Master of Quantitative Finance at a Glance

Why Earn a Master of Quantitative Finance at Smith?

Smith’s STEM-designated MQF combines both foundational knowledge of financial markets with rigorous coding and quantitative skills. Learn to apply math, probability, applied finance and coding within the financial services industry to develop strategies, manage risk and respond to rapid market changes. These skills can lead to careers in specialized fields like portfolio or derivatives management, algorithmic trading and financial engineering.

Promising Career Opportunities

The Master's in Quantitative Finance program prepares you to excel in the most quantitative roles within financial institutions. As a quantitative finance professional, you'll leverage your advanced coding skills, mathematical expertise and financial engineering knowledge to develop investment and risk modeling frameworks that guide high-stakes trades and investments.

Take a look at all of the exciting directions your career with an MQF degree:

Potential Job Positions

Salary Data

*Sources: GMAC, Smith’s Office of Career Services 2023 reporting; U.S. Bureau of Labor Statistics, Occupational Information Network.

Data for 2023 graduates who reported their salaries to Smith's Office of Career Services. Please note these figures do not meet the 75 percent MBACSEA reporting threshold.

Businesses who have hired our Master of Quantitative Finance Grads

- ANT Financial

- BlackRock

- Capital One

- Citi

- Constellation Energy

- Freddie Mac

- HSBC

- Morgan Stanley

- PwC

- RiskSpan

- UBS

- Wells Fargo

Upcoming Master of Quantitative Finance Events

Which Business Master’s is the Right Program for Me?

8:30 AM EST

MS Drop-In Hours for In-Person Programs

8:30 AM EDT

MS Drop-In Hours for In-Person Programs

8:30 AM EDT

Learn Advanced Finance Skills for an AI Future

As an MQF student, you’ll lean into a wide range of concepts ideal for a career in asset management, risk management or corporate finance. You’ll put your quantitative skills to full use as you explore concepts and tools, such as:

Industry-Specific Tools and Skills:

- AI in finance

- Coding in Python

- Financial data analytics

- Financial programming

- Risk modeling

Key Topics:

- Computational finance

- Financial engineering

- Financial programming

- FinTech

- Institutional asset management

- Machine learning

- Numerical methods and simulation

- Portfolio management

- Quantitative investment

- Textual analysis

Learn Through Hands-On Experiences

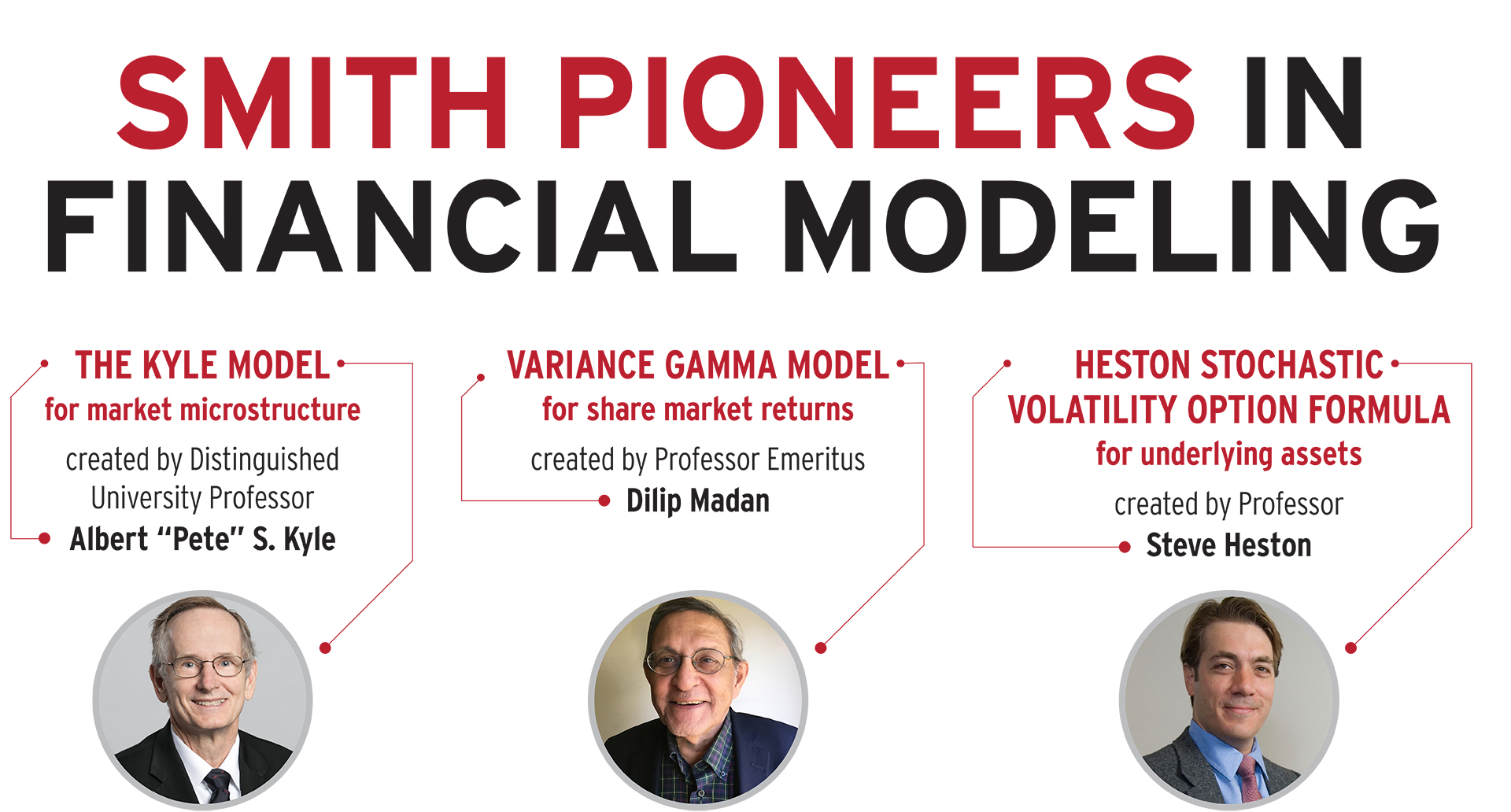

Our faculty—pioneers of widely adopted methodologies—foster an innovative learning environment. In the classroom, prepare to refine your risk management skills by helping real companies solve their business challenges. Our MQF students participate in case competitions, collaborate with risk experts for AI financial analysis and even have the opportunity to manage a portion of UMD's Global Equity Fund. If you're naturally curious and enjoy tackling complex problems with math, this dynamic field offers both an intellectual challenge and career fulfillment.

When I first came to Smith, what stood out to me most was that the student-run clubs came together to make our experience better professionally and personally. Everyone looked out for us.

Poulami Ghosh, MQF ’21

Senior Associate at PwC

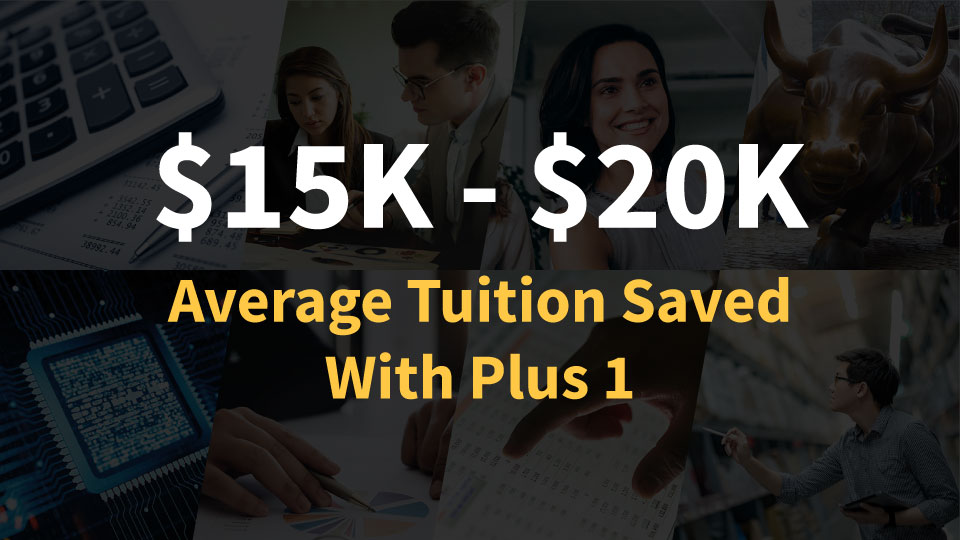

Available as a Plus 1 Program

If you’re a current University of Maryland freshman, sophomore or junior, you can pursue your Master of Quantitative Finance degree through the Plus 1 program. You'll save time and thousands of dollars on graduate tuition through this accelerated business master’s program.

Learn from Expert Faculty

Smith finance faculty are world-renowned both in academia and industry. They provide high-level Wall Street consulting, policy expertise to government and widely-used research and applications. In the classroom, you'll find them engaging and inspiring students, and they are committed to student success.

Academic Director

Michael Cichello

Michael Cichello

Academic Director, Master of Finance & Master of Quantitative Finance Programs

mcichell@umd.edu

Faculty

Lecturer

kfuller5@umd.edu

Professor

sheston@rhsmith.umd.edu

Associate Professor

skozak@rhsmith.umd.edu

Senior Lecturer

skroncke@rhsmith.umd.edu

Distinguished University Professor

akyle@rhsmith.umd.edu

Associate Professor

mloewens@rhsmith.umd.edu

William E. Mayer Chair in Finance

vmaksimovic@rhsmith.umd.edu

Professor of the Practice

crossi@umd.edu

Professor

unal@umd.edu

Paul J. Cinquegrana ’63 Endowed Chair in Finance

wermers@umd.edu

Associate Professor

lyang1@umd.edu

Master of Quantitative Finance News

Boost Your Professional Skills

Smith’s Office of Career Services (OCS) can help you bridge the gap between being a student and an employed professional. You’ll have one-on-one access to a career coach who will provide you with personalized tips on how to articulate your strengths when interacting with your future employer. Your coach will guide you as you refine your job search strategy, developing tangible next steps together.

Connect With Your Classmates

You’ll have plenty of opportunities to make connections at Smith and engage in exciting social activities through the Smith Masters Student Association. You can join an accounting-related club or others that provide you with general connections and skills.

Finance Advisory Council

Advisory Councils keep us actively engaged with industry leaders and experts, who bring their real-world experience to help shape what students learn, match classroom lessons to real-world needs, and widen the pipeline for internship and job opportunities.

Contact Us

Business Master's Office

2303 Van Munching Hall

College Park, Maryland 20742-1815

Phone: 301-405-2559

E-mail: SmithMasters@umd.edu

Hours: 8:30 a.m. to 4:30 p.m. Monday-Friday

Questions? Contact the MBA & Business Master's Admissions Office at 301-405-2559 or SmithMasters@umd.edu.