Master of Science in Accounting

Master of Science in Accounting

Full-Time, In-Person Program at UMD's College Park Campus

Explore how major businesses track and report their finances. You’ll gain specialized knowledge of analyzing and managing financial and tax data while following today’s strict accounting guidelines.

Why Get an MS in Accounting at Smith?

The Robert H. Smith School of Business STEM-designated Master of Science in Accounting (MSA) program provides you with valuable accounting knowledge extending far beyond the fundamentals most learn at the undergraduate level. You’ll learn to integrate AI, cybersecurity, data analytics and other advanced technological concepts into your work, giving you a competitive edge in today’s job market. The program can be completed in two or three semesters, fast-tracking your professional growth and helping you launch a great accounting career.

The Deloitte Foundation Accounting Scholars Program offers full tuition coverage for eligible students interested in pursuing the Master of Science in Accounting degree.

98% of our domestic and international MS in Accounting graduates secure job placement within six months of graduation.

Advance Your Accounting Skills Through AI-Powered Technology

We'll teach you advanced accounting methods and give you plenty of opportunities to gain hands-on experience with AI-powered tools and technology. These are key skills top employers seek when recruiting new talent.

In our AI Literacy course, you’ll learn how to transform raw, unstructured accounting data into clear and actionable insights. Courses such as Business Communications will show you how to leverage AI to address ethical challenges and can help you present your business findings in more compelling and effective ways.

The combination of advanced accounting expertise, AI literacy and business communication skills will prepare you to excel in a profession that is constantly evolving.

Here are the tools and concepts you can expect to use and learn in the MS Accounting program:

- Accounting analytics and valuation

- AI

- Alteryx

- Automation Anywhere

- Corporate and real estate taxation

- Cybersecurity

- Data-driven decision making

- Financial statement and data systems analysis

- IDEA

- Information security, audit and control

- Internal, external, forensic and automated auditing

- Internal, state, local and individual taxation

- Machine learning

- Microsoft SQL

- MindBridge Analytics

- Tableau and Power BI

Specialized Career Tracks

Choose a specialized track to acquire the targeted skills you’ll need in your accounting career.

Upcoming MS in Accounting Events

Which Business Master’s is the Right Program for Me?

8:30 AM EST

MS Drop-In Hours for In-Person Programs

8:30 AM EDT

MS Drop-In Hours for In-Person Programs

8:30 AM EDT

Alumni Profiles

Our MSA students pursue competitive and exciting accounting opportunities in their fields after graduating. Their experiences at Smith help them to expand their network, solidify their career goals and prepare them to perform their job responsibilities a step above the rest.

“In undergrad, a lot of businesses were looking for accountants and other business-related majors. I also felt business fields provided more opportunities for me to interact with people compared to public health, which is more research based. If you’re worried about the transition from a non-business undergraduate degree to a business master’s degree, it can be done.”

Margaret Chen

“Professor McKinney taught us the newest and latest technology being used in the audit industry. I use what he taught us on automating and streamlining processes in my current work.”

Ning Chi

Accountant at Kaboom!

"The biggest value for a master’s in accounting degree - especially if you’re going to the Big Four - is knowing that you have extra knowledge compared to an undergraduate student. The professors put it in a way where you understand how the work is done and what you’ll see in the real world."

Hector Chica

Audit Associate at CohnReznick

Play video

“One of the first projects I worked on was a financial statement analysis project. It showed me not only how to work through numbers, but also how to analyze numbers.”

Charlotte Cullen

Tax Associate at KPMG

Play Video

"Pursuing a degree in accounting was more investigative than I thought. One thing I thought would deter me from the program was the math aspect, but once I got there, everyone was so willing to teach me knowing that I didn’t have a background in accounting."

Adama Doukouré

Play video

“The networking potential of this program is second to none. The contacts you meet while you’re in the program are going to serve you all through your life going forward.”

Rick Rademacher

Senior Consultant at Deloitte

“Being able to interact and share experiences with students from all over the world is a rare opportunity. I've learned and expanded my knowledge of people from places I didn’t know much about.”

Christopher Rolle

Senior Audit Associate at KPMG

“The investigative mindset cultivated through my criminology and criminal justice undergrad major combined with the technical knowledge of accounting helps me come into forensic accounting with this ready-set-go mindset for finding and detecting fraud.”

Eleanna Weissman

Senior Auditor at EY

Play video

“My favorite course was Accounting Ethics with Professor Handwerger. Coming into it, he was supportive, kind and wanted to see us learn and evolve throughout the semester.”

Jakob Lang

MS Accounting '26

Play video

MS in Accounting at a Glance

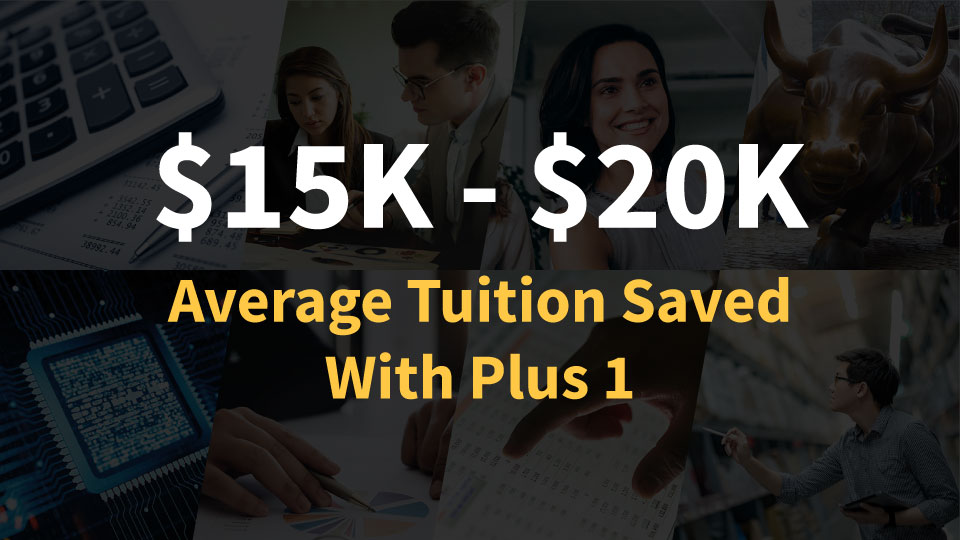

Available as a Plus 1 Program

If you're a current University of Maryland freshman, sophomore or junior, you can pursue your Master of Science in Accounting degree through the Plus 1 program. You’ll save time and thousands of dollars on graduate tuition through this accelerated business master’s program.

Apply and Receive Admissions Benefits

Maryland Advantage can make it easier for applicants who have completed an undergraduate and/or graduate degree in the United States to transition into the business master’s program by helping them save money on tuition, skip graduate entrance exams and get personalized career counseling before starting their program.

Learn from Expert Faculty

Your professors are industry experts and scholars who are invested in your success and will challenge you to take your skills to the next level. They are well-connected business leaders who offer guidance as you navigate through your professional journey.

Creator of Justice for Fraud Victims initiative and TerpTax, programs for students to get hands-on experience in investigating accounting activity to detect fraud and in tax preparation

Expert in taxation and accounting issues

Academic Director of the Master of Science Accounting program

Expertise includes cybersecurity, information systems and analytics

Allen J. Krowe teaching award recipient

Former CPA at PricewaterhouseCoopers

Expert in corporate financial reporting and intangible investment accounting

Director and Co-founder of the AI Initiative for Capital Market Research

scao824@umd.edu

Clinical Professor

jcrocker@umd.edu

Adjunct Faculty

ddenniso@umd.edu

Senior Lecturer

shandwer@umd.edu

Associate Dean of Research and Doctoral Programs

rhann@umd.edu

Adjunct Faculty

dharnish@umd.edu

Area Chair, Accounting and Information Assurance

mkimbrou@umd.edu

Associate Area Chair

jmckinne@umd.edu

Lecturer

pmcname1@umd.edu

Associate Clinical Professor

jmilton@umd.edu

Associate Professor

nseybert@umd.edu

Dean's Professor of Management Science and Operations Management

ttunca@umd.edu

Where Your Degree Can Take You

A Smith MSA degree prepares you to enter the high-demand accounting field in various settings, including Big Four accounting firms, the federal government and even nonprofit organizations. Whether you already have an undergraduate background in accounting or another subject area, this program is ideal for those interested in problem-solving, applying an investigative mindset to challenges and addressing discrepancies in business finances.

Sources: Smith Office of Career Services, 2022; Institute of Internal Auditors; Becker/ Accounting Today

*Data for 2024 graduates who reported their salaries to Smith's Office of Career Services. (49% reporting)

Picture Yourself in These Careers

“Because of the location and the people I’ve met here, I discovered what my career goal was. That was the most rewarding benefit I got from the program.”

Chen Zhang

Tax Senior at Ernst & Young

Businesses who have Hired our MS Accounting Graduates

- BDO

- CohnReznick

- Deloitte

- EY

- FBI

- Grant Thornton

- IRS

- KPMG

- Maryland Attorney General

- Morgan Stanley

- PWC

- RSM

Master of Science in Accounting News

The University of Maryland was named the top college in the nation for LGBTQ+ students by Campus Pride and BestColleges.

It…

Boost Your Professional Skills

Smith’s Office of Career Services (OCS) can help you bridge the gap between being a student and an employed professional. You’ll have one-on-one access to a career coach who will provide you with personalized tips on how to articulate your strengths when interacting with your future employer. Your coach will guide you as you refine your job search strategy, developing tangible next steps together.

Connect With Your Classmates

You’ll have plenty of opportunities to make connections at Smith and engage in exciting social activities through the Smith Masters Student Association. You can join an accounting-related club or others that provide you with general connections and skills.

MSA Advisory Council

Advisory Councils keep us actively engaged with industry leaders and experts, who bring their real-world experience to help shape what students learn, match classroom lessons to real-world needs, and widen the pipeline for internship and job opportunities.

Contact Us

Business Master's Office

2303 Van Munching Hall

College Park, Maryland 20742-1815

Phone: 301-405-2559

E-mail: SmithMasters@umd.edu

Hours: 8:30 a.m. to 4:30 p.m. Monday-Friday

Questions? Contact the MBA & Business Master's Admissions Office at 301-405-2559 or SmithMasters@umd.edu.