SERC Analytic Tools

Real World Applications, Designed by SERC Experts, Built by Smith Students

Working with Smith Enterprise Risk Consortium Director and Professor of the Practice, Dr. Clifford Rossi, Smith Masters students tackle real world problems and create analytic tools with practical applications. These tools are great examples of how SERC creates a bridge between academia and industry, giving students hands-on experience bringing data sets to life for real world decision making.

A Master in Quantitative Finance Experiential Learning Project

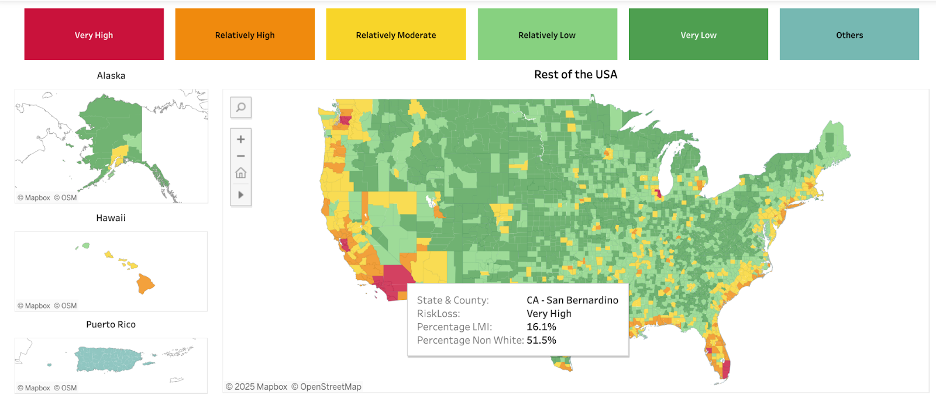

Interactive dashboard to see how any one of 18 natural hazards impact mortgage originations across the country.

A Master in Finance Independent Study Project

Snapshot of a bank’s vulnerabilities to any one of 18 natural hazards by branch branch, total deposits and secured assets.

Natural Hazard Mortgage Analyzer Highlights

- Public data sets from the Home Mortgage Disclosure Act (HMDA) and FEMA’s National Risk Index

- 13 million single-family mortgage loans

- 78,000 U.S. Census tracts, over 3,000 counties

- 18 different natural hazards, including earthquakes, wildfires, hurricanes, coastal and river flooding, tornadoes and drought.

- County-by-County analytics

- Risk level

- Percentage of low- and moderate-income borrowers

- Percentage of minorities

- Click on any county in the U.S. to see what the 2024 mortgage originations represent (see screenshot below).

This interactive dashboard is designed for banks—whether large institutions like JPMorgan Chase or small community banks—to understand how natural disasters such as floods, storms or heatwaves could affect their assets and branch locations.

"The tool has direct utility to bankers, regulators and other interested parties in assessing the risk to secured assets, says Professor of the Practice and SERC Director Clifford Rossi.

Natural Hazard Bank Branch Analyzer Highlights

- Incorporates 3 public data sets

- FDIC’s Branch Office Deposits – ~80,000 branches across US

- FEMA’s National Risk Index – 18 natural hazards

- FDIC’s Bank Call Report Data – quarterly snapshot of balance sheets, income statements and other detailed schedules of assets, liabilities, income and expenses on secured assets

- Filters selected bank branch metrics

- Branch count

- Deposits

- Secured assets

- Displays, at a glance, where banks’ secured assets are vulnerable to natural hazards.

Additional SERC-sponsored projects produced with master’s students and SERC interns:

- MQF Students Collaborate with Google Risk Experts for AI-Powered Financial Analysis

- Mortgage Credit Risk Remains Low, Stable in New Report from UMD’s Smith Enterprise Risk Consortium

- Smith Enterprise Risk Consortium Announces New Mortgage Risk Indexes

- Smith MQF Team Excels in ‘Credit Risk Transfer’ Project for Freddie Mac

- Smith Experts Assess Drug Manufacturing Risk from Natural Hazards

- New Analysis Examines Hurricane Risk Implications for Low-to-Moderate-Income Mortgage Borrowers