Corporate Finance

Foundations of Business Online Program

PROGRAM DETAILS

Start Dates: Enroll Immediately

Duration: 40 hours of content

Format: 100% Online

Tuition: $299

Program Description

In this course, you will learn the basics of finance by learning a little bit about each of the major finance topics. One of the key concepts in any finance class is risk. We will evaluate risk to decide whether to invest in different projects. Finance tells us that if you choose to take risks, then you want an appropriate reward for that risk. In other words, if you choose to invest in risky projects, whether you're speaking for yourself or a firm, then you will want a higher return from those risky projects than, say, investing in very safe treasury securities.

The two main areas in corporate finance are capital budgeting and financing. Firms need first to decide what projects they're going to invest in. To decide which projects would be sound investments, we will look at how cash flows are relevant to the capital budgeting decision and what is an appropriate discount rate to evaluate projects. We'll also determine whether these projects are positive net present value and, therefore, contribute to shareholder wealth. This is a critical decision for any company; if a firm can't find positive net present value projects, it will not stay in business very long. After the firm selects positive net present value investments, it must find financing for those projects. Here, we ask if the projects should be financed with new debt, new equity, or some kind of hybrid financing that uses a mix of debt and equity. In addition to corporate capital budgeting and financing, a major finance topic is investment or asset pricing.

Why take this course?

The objective of this course is to provide you with a broad exposure to the theory and practice of corporate financial decision-making. The skills that you learn in this course will serve you well not only in your professional life but also as you manage your own portfolio of securities and plan for your savings, your retirement, and your large purchases.

By the end of this course, you will be able to...

- Analyze corporate finance decisions, including investment decisions and valuation.

- Use time value of money concepts and formulas to solve investment and corporate finance problems.

- Apply finance concepts to the solution of financial problems.

- Analyze problems, weigh alternative solutions, and choose the best possible solution for a company's problems.

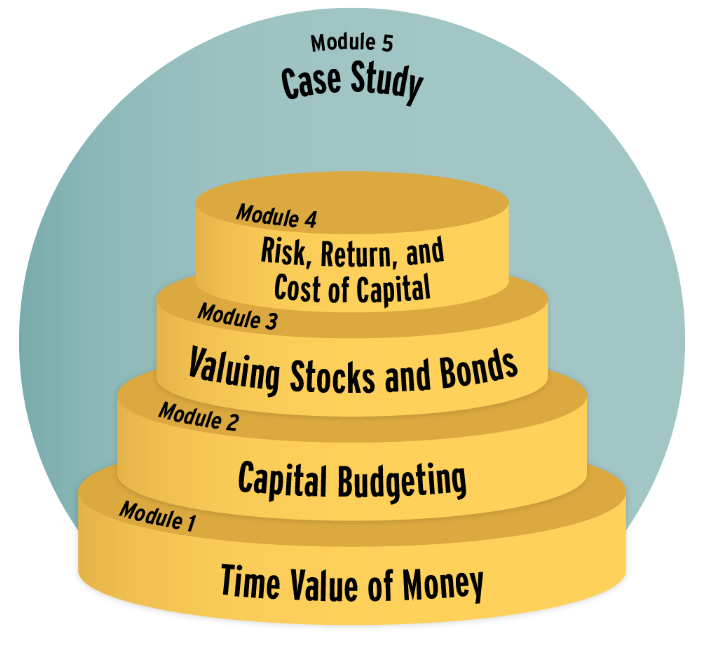

Course Topics

This module explores the theory behind the Time Value of Money (TVM) and looks at its many finance applications. There are many applications of TVM techniques. In business, it is used to decide what projects a firm should accept. In your personal life, you may use this to set goals for retirement savings or what mortgage or car loan terms you should accept. TVM is a fundamental tool in valuation. Most finance textbooks will tell you that the only acceptable goal of the firm is to maximize shareholder wealth. A firm maximizes shareholder wealth by maximizing stock price and maximizes stock price by accepting all possible positive net present value projects.

This module will equip you to:

- Analyze corporate finance decisions, including investment decisions and valuation.

- Use time value of money concepts and formulas to solve investment and corporate finance problems.

- Find PV of a stream of even and uneven cash flows.

- Find the net present value or NPV (PV of benefits minus PV of costs), internal rate of return (IRR), and payback.

- Explain why maximizing NPV is always the correct decision rule.

- Break complex time value of money problems into their component parts and solve them.

Valuation is the core of corporate finance, and capital budgeting is the core of valuation. A firm will not survive long if it cannot successfully find positive net present value projects in which to invest. Finding potential projects is beyond the scope of this course, but once projects are found, they need to be evaluated, which we will learn to do here. This module examines how to determine whether a project has a positive net present value, looking at defining and calculating relevant cash flows, calculating depreciation and its impact on value, and choosing an appropriate discount rate.

This module will equip you to:

- Identify relevant cash flows for a capital budgeting problem.

- Explain why opportunity costs must be included in cash flows while sunk costs, overhead, and interest expenses must not.

- Calculate taxes that must be paid, including tax loss carryforwards and carryback.

- Calculate free cash flows for a project.

- Illustrate the impact of depreciation expense on cash flow.

- Calculate MACRS vs. straight-line depreciation and its impact on your final answer.

- Describe the appropriate selection of a discount rate for a particular set of circumstances.

This module focuses on stocks and bonds, investments in which corporations and individuals invest. As with capital budgeting projects, to find the value of stocks and bonds, we need to determine appropriate cash flows and discount rates. We’ll also look at the returns from stocks and bonds, which we’ll use in the future to calculate portfolio returns and the cost of capital.

This module will equip you to:

- Use the dividend discount model to compute the value of a dividend-paying company's stock, whether the dividends are constant, grow at a constant rate, or grow at a non-constant rate in the future. This includes calculating terminal value at time N when growth becomes constant at some point in the future.

- Calculate the value and yield to maturity of coupon & zero-coupon bonds.

- Determine the change in the price of bonds due to changes in interest rates; determine the impact of the coupon rate and maturity on this change.

The relationship between risk and return is a critical topic in finance. If you take on risk, then you will want an appropriately high return, but what is the appropriate return? This module will look at how risk is measured, what risk is relevant, and how a return is calculated given a specified amount of risk. This is an important concept for firms; remember, a company will not stay in business long if its return cannot compensate for the riskiness of its projects. It is important for individuals as well. Investors need to determine what level of risk they are willing to take and how to mitigate those risks, for example, through a diversified portfolio.

This module will equip you to:

- Compute the realized or total return for an investment.

- Calculate the total return of a stock, given the dividend payment, current price, and previous price.

- Given a portfolio of stocks, compute the key risk and return metrics of the portfolio utilizing information about the individual stocks.

- Discuss how beta can be used to measure the systematic risk of a security.

- Use the capital asset pricing model to calculate the expected return for a risky security.

- Explain why, in an efficient capital market, the cost of capital depends on systematic risk rather than diversifiable risk.

- Use CAPM to determine whether an asset is undervalued or overvalued. Define and calculate beta for an individual stock and for a portfolio.

- Describe common proxies for the market return and the risk-free rate.

- Estimate the cost of debt.

- Calculate the weighted average cost of capital, with and without corporate taxes

- Illustrate the effect of a change in debt on weighted average cost of capital in perfect capital markets, including the effect of leverage on beta.

In this final module, you will work through a scenario by performing discounted cash flow and comparable multiples valuations, calculating the weighted average cost of capital, and listing potential synergies from acquiring a company or merging with another company.

Format & Structure

The course is completely self-paced. It will take you approximately 40 hours to complete all five modules. Activities include video lessons, readings, and self-reflection activities. Upon completing this course, you will receive a certificate of completion:

This is an asynchronous, self-paced course. That means that you can work at your own speed. There are review questions after most videos and reading. These questions are ungraded and designed for you to check your understanding of the content before moving on. As this course is quantitative, our goal is to give you as much practice as possible. We typically start by introducing you to concepts that you need to understand, followed by the equations. We then demonstrate very concrete examples of how to solve case-based problems before asking you to try some problems on your own.

Smith Faculty