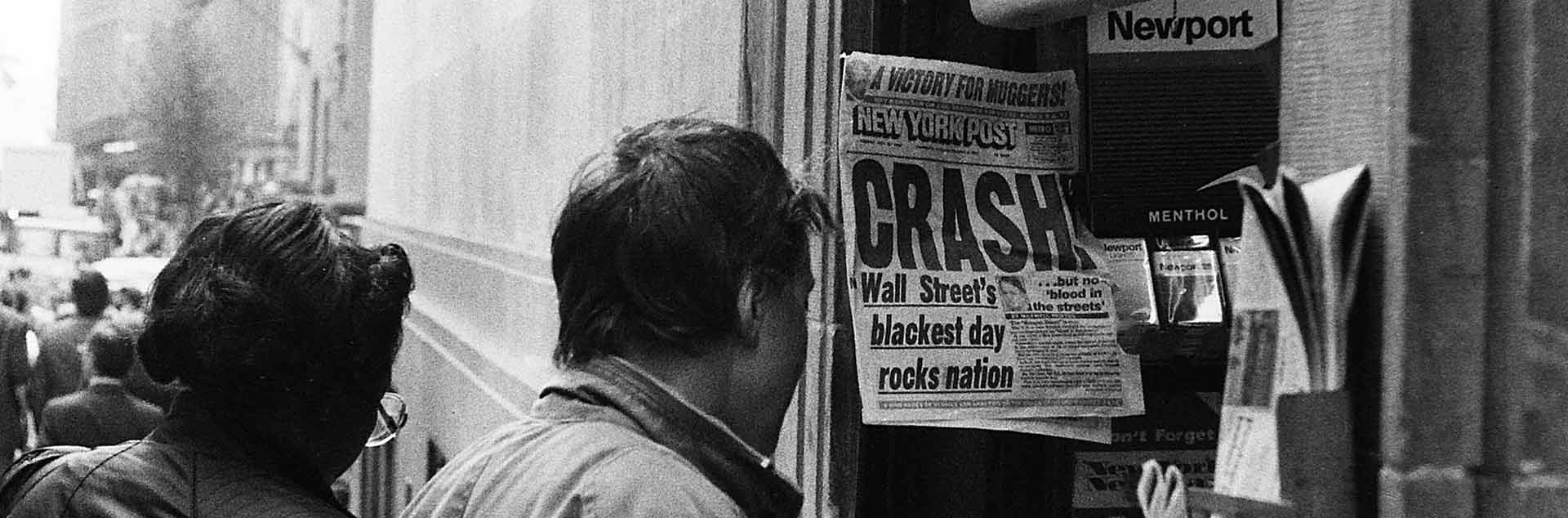

SMITH BRAIN TRUST – Today marks the 30th anniversary of Black Monday, the biggest single-day stock market drop in history. The 23 percent drop triggered many changes to the way markets were structured. Smith School professor Albert “Pete” Kyle has developed a formula to predict the size of crashes based on a new theory called “market microstructure invariance.” Kyle investigated the crash for a presidental task force known as the Brady Commission.

Now Kyle, the Charles E. Smith Chair Professor of Finance at the University of Maryland's Robert H. Smith School of Business, is recommending new changes to the ways stock markets are structured. Since that fateful Black Monday, technology has made it easy to trade high volumes with computer algorithms. Current electronic markets make it easier for flash crashes to occur because they lack a human braking mechanism.

Kyle says most traders, trying to make the most money on their transactions, spread their buying and selling out over a period of hours, days or weeks to stay under the radar of other traders. In practice, this does not actually always work. Traders assume that other traders are buying or selling slowly in an attempt to stay under the radar, too, so they make adjustments for that. Problems occur when traders do not play by these rules.

“If you don’t try to stay under the radar and you trade rather quickly to your target inventory, the other traders in the market would assume that you had some fantastically big information and the price would react very violently if you tried to do that: a flash crash.”

This is what happened in the 2010 Flash Crash, a 36-minute stock market crash where markets plunged 998.5 points then rebounded. Many people think that if you stop trading, the price should stay where it is, but that’s not what happens. If you have been buying a lot and then suddenly stop, that sends a big negative signal to the market. That’s why flash crashes end: Someone comes into the market and starts selling a lot, and then they stop. When they stop, the market bounces back to end the flash crash.

Kyle says future such crashes can be avoided if markets change to account for the way most traders act. He is proposing that stock exchanges should change the way that orders are placed, moving to a continuous limit order book.

As part of his latest research, Kyle recommends traders not only place an order specifying buying a certain number of shares, but part of the order also should be the maximum speed at which they want to buy it. If the orders had that component, then the exchanges can let the trading take place continuously. This requires breaking things down into tiny fractions – nanoshares, microdollars, milliseconds – so a trader accumulates fractions of shares throughout the day until they eventually fulfill their order.

Currently, if you want to buy 10,000 shares over 3 hours, for example, you might place 100 orders of 100 shares each, consciously managing gradual trade, says Kyle. This is often done automatically with algorithmic trading. Algorithms will chop an order into very small pieces and submit an order every couple of minutes, automatically adjusting the price as necessarily to make sure an order goes through.

If markets were set up for continuous trading as Kyle suggests, traders would just have to send one order, making time and price and quantity essentially continuous. That makes things much more efficient, he says, and addresses some of the problems with high-frequency trading. High-frequency traders invest lots of resources in technology, trying to be a microsecond or a millisecond faster that everyone else. Having a continuous exchange would level the playing field and eliminate the advantage high-frequency traders have now when their faster technology allows them “pick off” other orders.

“That proposal by itself is not going to eliminate flash crashes because they are intrinsically caused by people trading too aggressively,” says Kyle. “If you trade aggressively and buy too many shares per second, you’re going to have a huge effect on the price of a stock. Our proposal makes you think about that before you submit your order. A lot of people don’t think, and that’s part of what is going on.”

GET SMITH BRAIN TRUST DELIVERED

TO YOUR INBOX EVERY WEEK

Media Contact

Greg Muraski

Media Relations Manager

301-405-5283

301-892-0973 Mobile

gmuraski@umd.edu

Get Smith Brain Trust Delivered To Your Inbox Every Week

Business moves fast in the 21st century. Stay one step ahead with bite-sized business insights from the Smith School's world-class faculty.