Financial Accounting

Foundations of Business Online Program

PROGRAM DETAILS

Start Dates: Enroll Immediately

Duration: 30 hours of content

Format: 100% Online

Tuition: $299

Program Description

Accounting is often called the language of business. Using the vocabulary and grammar of this language, a business entity communicates with those interested in its activities, such as investors, creditors, and regulators. The primary focus of Financial Accounting is the preparation, understanding, and analysis of financial statements – income statements, balance sheets, and the statement of cash flows. These statements report a company’s profitability and financial health and are useful to all economic agents engaged with the firm. The purpose of this course is to provide you with the concepts and tools needed to understand and effectively use a company’s external or financial accounting information system.

Why take this course?

There are videos, reading, interactive practices, and knowledge check questions. There are also module review questions at the end of each module. All of it is meant to help guide you through the topics and concepts in this course and get you ready for the final exam. As this course is quantitative in nature, our goal is to give you as much practice as possible. Some modules cover more topics and, as such, might have more practice and review questions. These are non-graded activities meant to help you master the content and prepare you for the Final Exam.

By the end of this course, you will be able to:

- Utilize accounting techniques to evaluate the financial health of a company

- Analyze how financial transactions impact financial statements

- Use available computing technology (e.g., spreadsheets) interpret make inferences about underlying populations

- Utilize financial statements to make informed managerial inferences and decisions

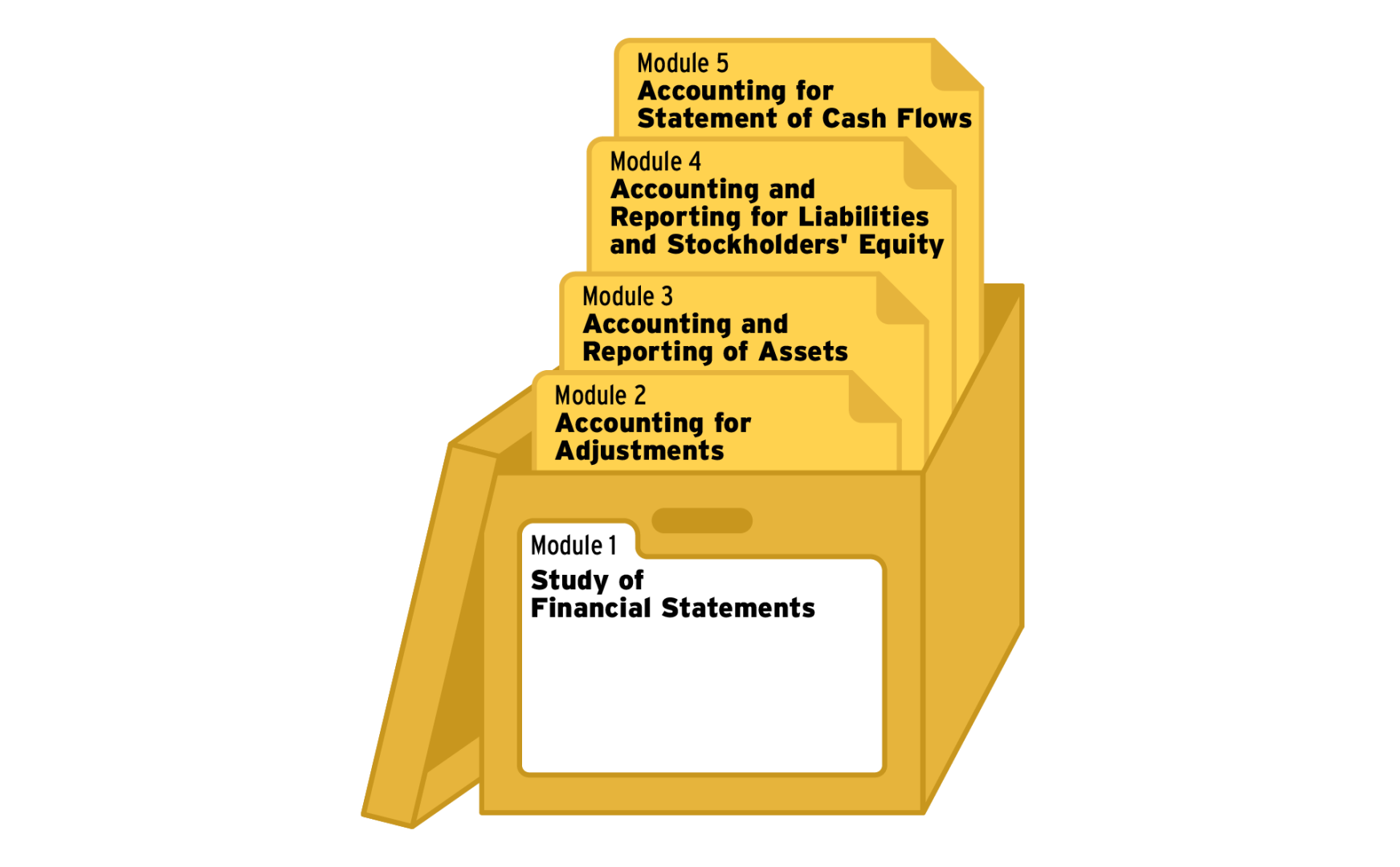

Course Topics

Module 1 focuses on why financial statements are important to us. You will carry this information throughout the rest of the course, and it will provide a strong foundation for your understanding of financial accounting.

This module will equip you to:

- Identify the role accounting plays in evaluating the financial performance of a corporation.

- Apply transaction analysis to common business transactions in terms of the basic accounting equation: Assets = Liabilities + Owners' Equity.

- Recognize the information conveyed in each of the four basic financial statements and the way it is used by decision-makers.

- Determine the impact of business transactions on financial statements using journal entries and T-accounts.

In this module, we will review adjustments and their effect on financial statements. We will practice adjusting entries and see how financial statements are adjusted at the end of every year to make the financial statements accurate.

This module will equip you to:

- Explain the purpose of adjustments in light of the revenue recognition principle and the expense recognition (matching) principle.

- Analyze the four types of adjustments necessary at the end of an accounting period to update financial statements.

- Identify the effect of adjustments on prepaid (deferred) expenses, unearned (deferred) revenues, accrued expenses, and accrued revenues.

- Adjust entries on an income statement to explore the effect that entries have on the balance sheet.

In Module 3, we will look into inventory and receivables and how to report and interpret them based on information available on the financial statements. We will also explore Long-Term Assets and apply various principles and methods to understand the different effects that specific actions can have on assets.

This module will equip you to:

- Explore the importance of effective accounting of inventory and the effects of inventory errors.

- Utilize four inventory costing methods to report inventory and cost of goods sold.

- Analyze the effects of inventory costing methods on the income sheet and balance statement.

- Utilize methods for estimating and accounting for accounts receivable, interest revenue, and bad debts.

- Define long-term assets.

- Apply depreciation methods as economic benefits are used up over time.

- Analyze the disposal or retirement of long-term tangible assets.

- Explore how natural resources and intangible assets are handled in financial accounting.

In Module 4, you will learn about the accounting procedures and financial ratios used to report and interpret liabilities and how they influence credit ratings. Although we focus on corporate reporting and analyses, this chapter can also help you to understand the kind of information others use to evaluate your open personal credit rating. We will also explore the role of stock and stockholders within a corporation. Through analysis of stockholders' equity, you'll be able to understand the role that it plays in financial accounting within corporations.

This module will equip you to:

- Explain the role of liabilities in financing a business.

- Practice measuring liabilities, account for current liabilities, and long-term liabilities.

- Analyze and record bond liability transactions.

- Calculate and interpret the times' interest earned ratio, and use the results to evaluate liabilities.

- Use effective-interest bond amortization.

- Account for installment notes payable.

- Explain the role of stock in financing a corporation.

- Analyze common stock transactions, cash dividends, stock dividends, and split stock transactions.

- Define preferred stock and analyze transactions that affect the preferred stock.

- Define and analyze earnings per share, return on equity, and price-earnings ratios.

- Record journal entries for large and small stock dividends.

In Module 5, we will look into the statement of cash flows and interpret cash flows from different activities within the corporation. By using different methods, we can prepare a complete statement of cash flows.

This module will equip you to:

- Report and interpret cash flows from operating, investing, and financing activities.

- Report cash flows from operating activities using the indirect method.

- Report cash flows from operating activities, investing activities and financing activities using the direct method.

- Summarize the statement of cash flows.

Format & Structure

The course is completely self-paced. It will take you approximately 50 hours to complete all five modules. Activities include video lessons, readings, and self-reflection activities. Upon completing this course, you will receive a certificate of completion:

This is an asynchronous, self-paced course. That means that you can work at your own speed. There are review questions after most videos and reading. These questions are ungraded and designed for you to check your understanding of the content before moving on.

Smith Faculty