By Smith MarComm graduate intern James Consoli

Each year, a select few students at the University of Maryland’s Robert H. Smith School of Business take part in a profoundly unique learning experience: they manage real money—millions of it.

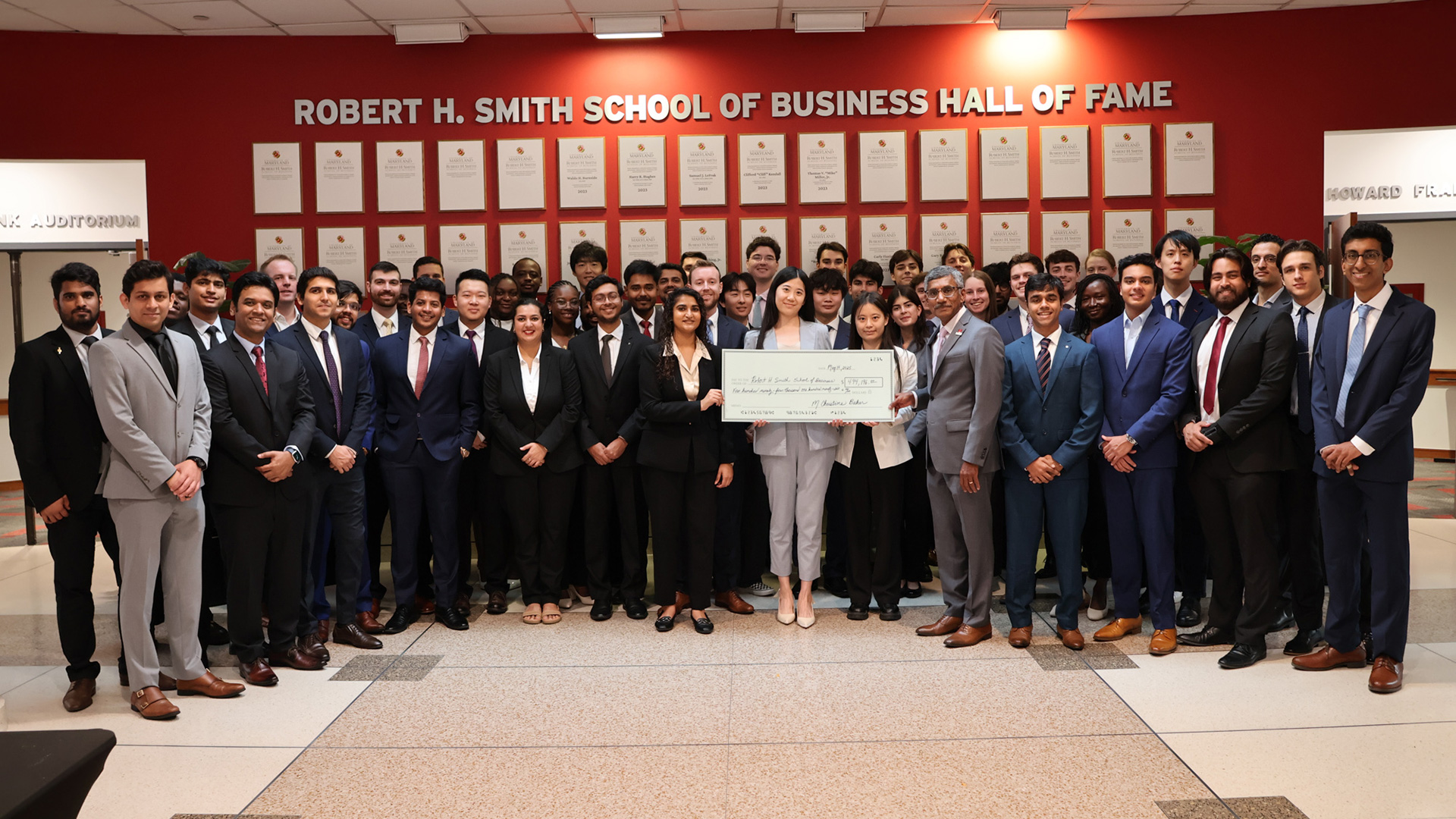

Out of hundreds of applicants across graduate and undergraduate levels, fewer than 50 are chosen annually to join one of Smith’s three student-run investment funds—The Mayer, Senbet and Global Equity funds.

These funds, which collectively manage just under $12 million in assets, don’t operate in simulation—they’re backed by the University of Maryland Foundation, ranking as the 14th-largest student-run investment fund program in the country, according to the Center for Investment Research.

This past fiscal year, they not only performed but revealed just how powerful real-world, but insulated, learning can be.

For graduate student Teddy Strozyk, MBA ‘25, his experience managing the Global Equity Fund was about much more than achieving a target return.

Balancing a full-time engineering job with his pursuit of an MBA, Strozyk spent his nights researching, modeling and pitching stocks for the fund, which focuses primarily on international markets.

Strozyk’s most memorable moment came after pitching Spotify, a stock he identified as undervalued based on its profitability breakthrough and global scalability. The fund bought in at around $400 a share. Days later, it surged to nearly $600.

“We came into class the next week applauding him,” says Dennis Yudkovich, MBA ‘25. “It was our biggest growth stock. He nailed it.”

Their success wasn’t isolated. The Global Equity Fund finished the year with a 7.08% return, outperforming its benchmark, the MSCI All Country World Index ex-U.S., which returned 6.02%. It stood out as the only Smith fund to do so.

The fund, which typically features 13 to 20 graduate students, often working professionals in the Flex MBA or Master of Finance programs, navigated global uncertainty and market swings with a keen eye on both potential risk and opportunity.

Faculty advisor Kenneth Fuller, who has led the Global Equity Fund for eight years, says the results were impressive, but the deeper goal was always clear: “It’s one thing to model a portfolio on paper. It’s another to wrestle with real money and feel what that responsibility means.”

“You’re encouraged to debate. If you don’t like an idea, say it. There’s no time for hurt feelings in asset management,” Fuller adds.

Meanwhile, the Senbet Fund—Smith’s undergraduate counterpart—found success through patience. Composed of 12 senior finance majors, the fund returned 8.07%, the highest of the three. Ryan Baumbach ‘25, who led coverage of the energy and utilities sector, attributes the strong showing to the team’s restraint in the face of an uncertain market.

“In the fall, we thought the markets were too hot. So most of our pitches were holds,” says Baumbach. “It was tough, but it was the right call.”

By spring, market conditions had shifted, and the team acted accordingly. They made six buy trades, including Baumbach’s pick of International Seaways, a petroleum shipping company that subsequently performed well. For him, though, the real win was in collective growth.

“Everyone came in with different backgrounds—some had investment banking experience, some didn’t. But we helped each other grow,” says Baumbach. “It was the most rewarding experience I’ve had at Smith.”

The Mayer Fund, Smith’s oldest and largest student fund, adopted a more conservative approach this year, returning a 4.63% yield. Its legacy dates back to the 1990s, when then-Dean Bill Mayer created it as a capstone for full-time MBA students.

This year, students focused primarily on U.S. equities and positioned the fund defensively amid the uncertainty of an election year. Despite missing out on high-flying names like Nvidia, they gained something equally valuable: a clear understanding of how macroeconomic and policy decisions shape the markets.

Sarah Kroncke, faculty advisor to two of the three funds, says, “They studied real issues like tariffs and interest rate shifts. They made decisions based on what the market was telling them—and that’s exactly the kind of learning we want to see.”

Throughout the year, students in all three funds utilized institutional tools, including Bloomberg, Morningstar and Workspace, which provided them with access to the same data that professional analysts use daily. They conducted rigorous DCF valuations, debated macroeconomic trends and learned how to pitch investment ideas to a room of peers ready to challenge them.

The results speak volumes—not just in performance, but in outcomes. Graduates from the funds have gone on to roles at Moody’s, American Express and J.P. Morgan, with many citing the experience as a defining feature on their resumes. Baumbach, who begins work in wealth management at J.P. Morgan this year, believes it “is by far the best opportunity for undergraduates at the Smith School.”

Fuller agrees, with each cohort of students serving as stewards of the funds and upholding the expectation of leading them with integrity.

“There’s a real pride of ownership,” says Fuller. “They know this isn’t just a class—it’s a responsibility. And they rise to it.”

Media Contact

Greg Muraski

Media Relations Manager

301-405-5283

301-892-0973 Mobile

gmuraski@umd.edu

About the University of Maryland's Robert H. Smith School of Business

The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and flex MBA, executive MBA, online MBA, business master’s, PhD and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia.