Financial Wellness

Focused on the Financial Well-being of the University of Maryland Community

The Financial Wellness Center at the University of Maryland is poised to revolutionize financial literacy among students, empowering them to make informed financial decisions that pave the way for lifelong success.

Learning to responsibly manage money, borrow, save and plan for the future while in college significantly influences a student's financial well-being after college. Providing students with the financial knowledge, skills, and abilities necessary to make informed financial judgements will not only promote their financial success but also increase retention and graduation rates.

TerpTax offers free, IRS-certified tax preparation for low- to moderate-income individuals in the UMD community. Our trained student volunteers help you file with confidence while providing tax education—empowering clients financially and giving future professionals valuable, real-world experience in return.

TerpTax offers free, IRS-certified tax preparation for low- to moderate-income individuals in the UMD community. Our trained student volunteers help you file with confidence while providing tax education—empowering clients financially and giving future professionals valuable, real-world experience in return.

The Justice for Fraud Victims Project (JFV) is a nonprofit initiative offering pro bono forensic accounting services to fraud victims and their families. Learn how to avoid becoming a victim—and if you or someone you know suspects fraud, contact us for help.

The Justice for Fraud Victims Project (JFV) is a nonprofit initiative offering pro bono forensic accounting services to fraud victims and their families. Learn how to avoid becoming a victim—and if you or someone you know suspects fraud, contact us for help.

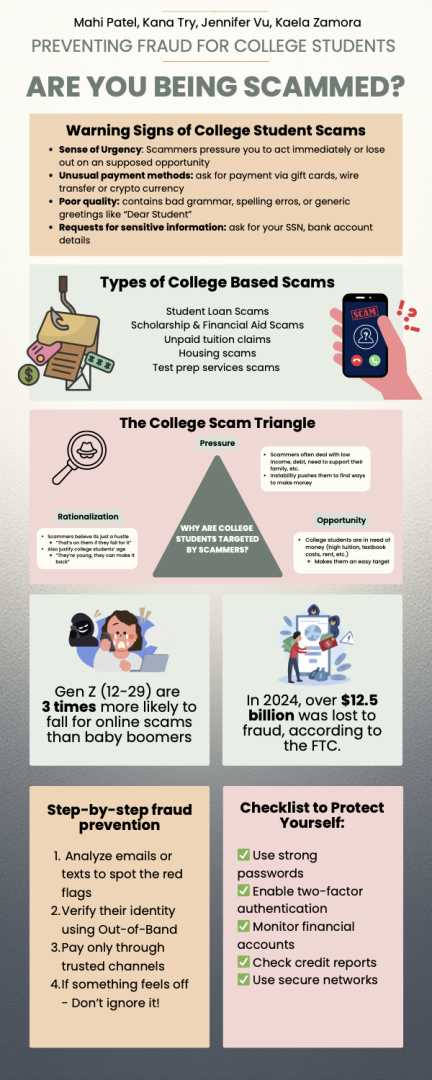

Preventing Fraud for College Students: Spot the Scam Before It Spots You

College students are prime targets for scammers exploiting financial stress and inexperience. This infographic breaks down the most common scams — from fake scholarships and housing listings to bogus student loans — and offers a simple checklist to protect yourself. Learn to recognize red flags like urgent demands, unusual payment methods, and requests for sensitive info. Stay smart, stay secure, and don’t let fraud take your focus off your education.