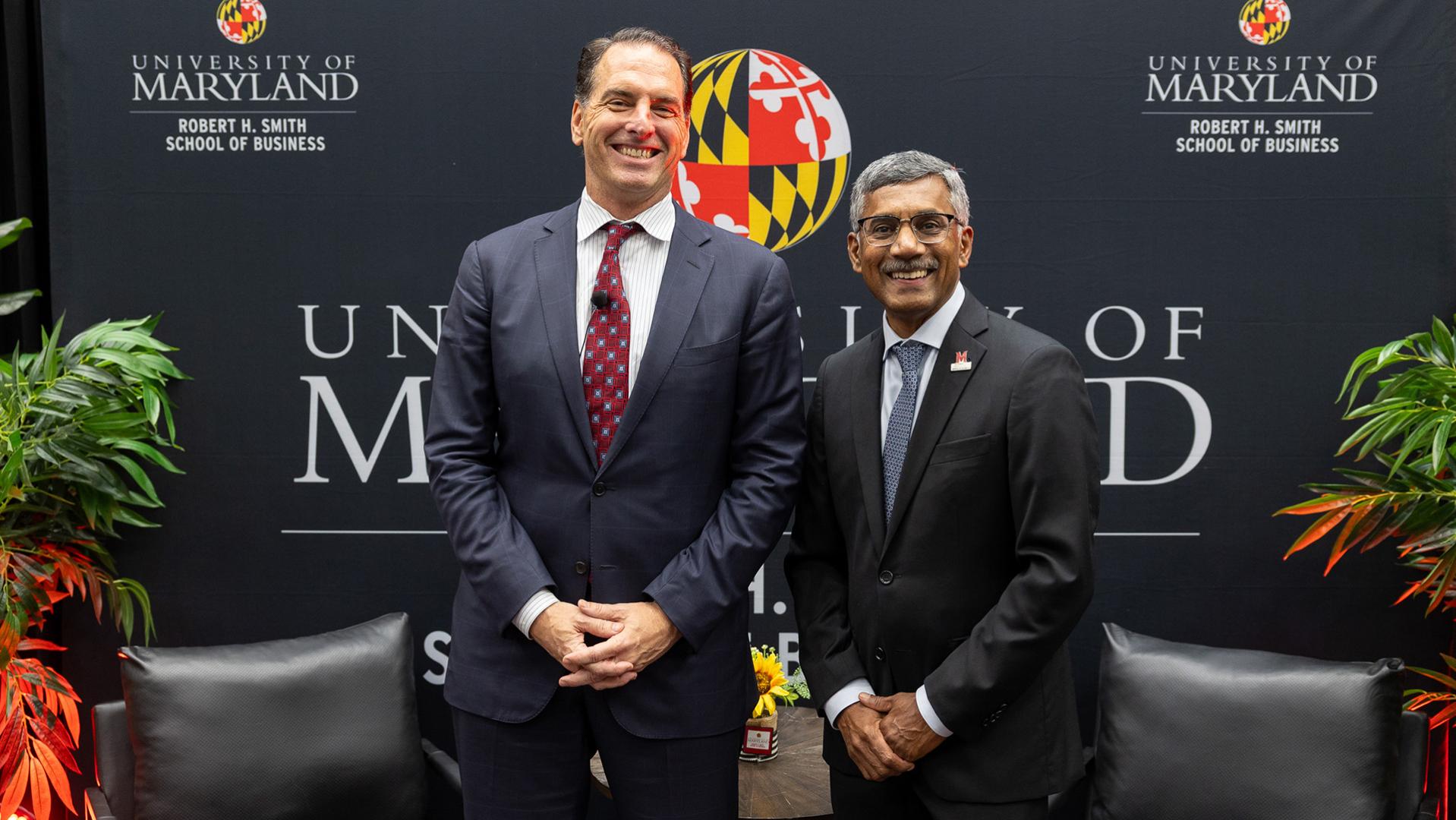

Former Deputy Secretary of the U.S. Treasury Michael Faulkender candidly discussed tariffs, fiscal policy, inflation and the current economic climate with Smith School Dean Prabhudev Konana in front of a packed audience of students, alumni, faculty, staff and guests in Van Munching Hall on Sept. 24, 2025. Faulkender, the William E. Longbrake Professor of Finance, served in the No. 2 post at the Treasury until earlier this year. The fireside chat was the first event in the Dean’s Distinguished Speaker Series and just one of many this fall to encourage students to engage in civil discourse, ask questions and think independently.

“We may not all agree, but we heard your side on why some tough choices were made and how these big decisions impact the entire world,” Konana said, thanking Faulkender for sharing his perspective and being honest with his answers. “We want to have more of these conversations and we want students to push back. That’s how learning happens.”

As the 16th deputy secretary, Faulkender was the chief operating officer of the Treasury, overseeing a staff of about 120,000 when he took on the role in March 2025. He was responsible for day-to-day operations of the vast department, which also includes the Internal Revenue Service, the U.S. Mint, the Bureau of Engraving and Printing, the Bureau of the Fiscal Service, the Financial Crimes Enforcement Network, the Trade and Tobacco Bureau and Main Treasury. He aided in shaping policy on sanctions, financial markets regulation, taxation, and international economic issues. His operational responsibilities included “everything from the next security features for the $100 bill, to decisions about commemorative coins for the 250th anniversary of this country” to which activities to target with sanctions to what industries are covered by reducing taxes on tipped income. He also served as the acting commissioner of the Internal Revenue Service for two months this year. In the first Trump administration, he served as the Treasury’s chief economist where he implemented the Paycheck Protection Program to provide relief during the Covid pandemic. For that work, he received the department’s highest honor, the Alexander Hamilton Award, in January 2021.

Konana steered clear of politics in this conversational event, titled “Economic Policy from the Inside,” and instead asked Faulkender to share his scholarly insights to explain the rationale behind certain policies and the intended and unintended consequences.

Faulkender talked about international trade and the use of tariffs to encourage more production of certain goods and resources vital to national and economic security – things like mining critical minerals and manufacturing essential technologies and certain pharmaceuticals, but argued that they are less necessary for industries like textiles.

“The strategic deployment of tariffs for purposes of creating the incentives to generate that capacity so that we don’t have a future vulnerability is what a number of us in the administration were advocating,” he said.

“We need a certain base amount of manufacturing capacity that can be redeployed in times of national emergency so that we can generate domestically the tools and machines that we need to defend ourselves,” he said.

Konana pressed Faulkender on how to balance the frictions of retaliatory tariffs and the impact to U.S. consumers and producers.

Faulkender talked about “the way the game is played” when negotiating internationally, the rationale behind implementing tariffs, and the strategy he advocated to phase in tariffs.

“There was a lot of uncertainty created at the very beginning because the president had an aggressive agenda to change direction on a number of fundamental things, and my job at Treasury every day was to reduce that uncertainty and provide clarity,” he said.

Faulkender fielded questions from Konana and audience members, who pushed the conversation to how the tariffs impact consumers and inflation, GDP, energy production, domestic manufacturing, national security, interest rates and the Federal Reserve, maintaining the dollar as the world’s reserve currency, and equity market impacts, among other topics.

Faulkender also shared his views about monetary policy and said the Federal Reserve has too many competing responsibilities.

“I think we need to get back to a much narrower version of the Fed,” he said. “Were it to be tailored, it is much easier to maintain independence.”

He said he disagreed with the government’s recent purchase of a 10% equity stake in Intel.

“My students know I am one of the biggest capitalists they’ve ever met,” he said. “I fundamentally, philosophically, religiously believe in the incentives of private ownership, private allocation of capital, private risk-taking, private control.”

The Dean’s Distinguished Speaker Series builds on the Financial Grand Challenges speaker series that Faulkender created at the Smith School in 2024. The goal for this series is to bring together leading voices who can share fresh perspectives on the most pressing economic and financial issues of our time, with thoughtful dialogue and respectful discourse.

Media Contact

Greg Muraski

Media Relations Manager

301-405-5283

301-892-0973 Mobile

gmuraski@umd.edu

About the University of Maryland's Robert H. Smith School of Business

The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and flex MBA, executive MBA, online MBA, business master’s, PhD and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia.