Mayer Fund

Hands-on immersion in asset management.

At the University of Maryland’s Robert H. Smith School of Business, we have pioneered the hands-on study and understanding of professional asset management.

In 1993, a $250,000 contribution from our College of Business and Management Foundation established the Mayer Fund. The Fund, which has grown to over $5 million through appreciation and outside contributions, is managed by a team consisting of a select group of second-year MBA students at the Smith School.

Consisting of two portfolio managers, and eight to ten equity analysts, the student management team is charged with meeting the Fund's long-term performance goal of achieving capital appreciation that outpaces the appreciation of the S&P 500 on a risk-adjusted basis.

Equally important to achieving that primary goal is the underlying objective of helping each team member understand the processes involved in managing assets and making critical investment decisions in a global marketplace marked by volatility and continual change.

The Mayer Fund has yielded valuable returns: Members of the management team learn about stock selection, equity analysis and portfolio management. They meet with Wall Street and local financial professionals. They get jobs with world-class companies. And their work has provided a five percent annual dividend to the Smith School and enhanced its reputation.

At the Smith School, doing business is integral to business learning.

How to Join

The application and selection process is conducted each academic year between December and February. A recruiting presentation is provided each fall by current Fund members, providing an overview of the Fund, involvement criteria and an application timeline.

"The practical lessons learned actually managing a portfolio not only reinforce academic experience but differentiate Maryland MBAs from other students as they interview for Wall Street." — John Boyle, Managing Director, ThinkEquity Partners LLC.

The Mayer Fund is a year-long, advanced finance seminar for second-year full-time MBA students. The seminar provides them with the opportunity to apply what they have learned in finance classes to actual investment decisions and to enhance their skills and knowledge in this area. As part of their training, the students discuss a variety of topics in the seminar, including:

- Portfolio management theory and practice

- Security screening and selection

- Economic and industry analysis

- Corporate qualitative and financial analysis

- Valuation analysis

- Trading strategies

Additionally, students learn from reviewing the results of the decisions they make, determining which strategies to replicate and which strategies to avoid in the future.

Not only does the Mayer Fund provide MBA students with knowledge and skills to enhance their career opportunities, it also provides them with:

- Valuable industry contacts

- Guest membership in the Washington Society of Investment Analysts

- Market experience and opportunities to use industry tools, such as First Call, SDC, and DAIS databases

Former Mayer Fund members have put their skills and knowledge to work for a number of organizations, including:

- Allen & Company

- Bank of America

- Barclays

- BB&T

- CIGNA Retirement & Investment Services

- Credit Suisse First Boston

- Deloitte & Touche Consulting Group

- Deutsche Bank

- Fidelity Investment Management

- Friedman, Billings, Ramsey & Co. Inc.

- JPMorgan Chase

- Legg Mason Wood Walker, Inc.

- Lord Baltimore Capital Corporation

- Marriott Corporation

- Mercantile Safe Deposit & Trust Co.

- Merrill Lynch

- Pilgrim Baxter & Associates

- PriceWaterhouseCoopers

- Prudential Securities

- Scott and Stringfellow

- Standard and Poor's

- Stanford Keene

- ThinkEquity Partners LLC.

- Wallace Willmore Cromwell & Co.

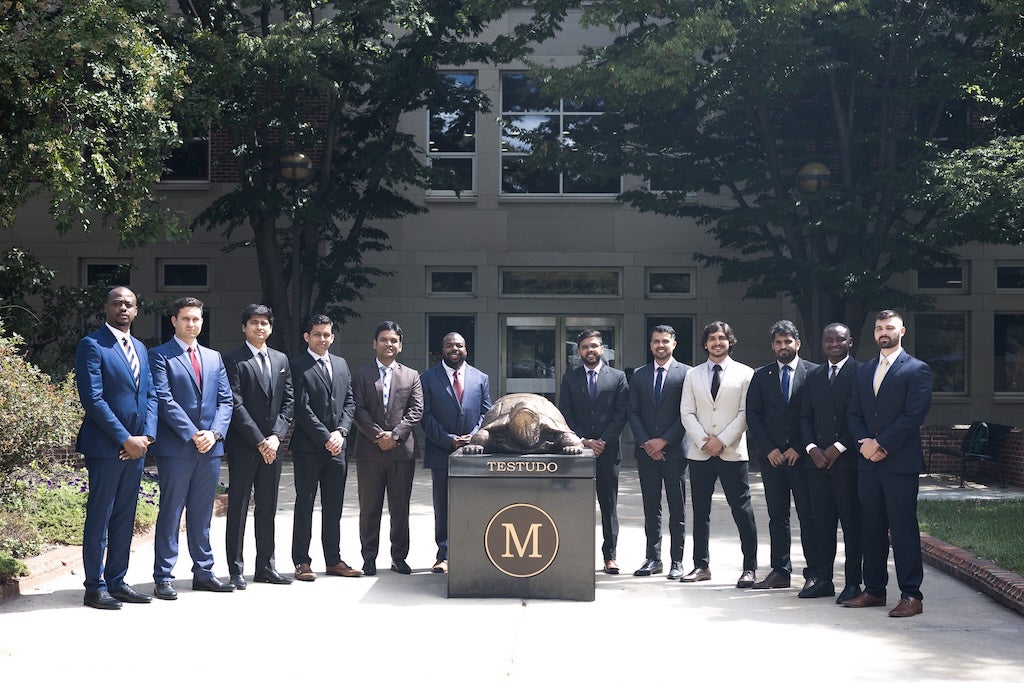

Class of 2026

The equity analysts and portfolio managers were selected through a rigorous application and interview process based on their financial and analytical skills, leadership qualities, work ethic, professional accomplishments, and ability to represent the Robert H. Smith School of Business. They oversee every aspect of the Mayer Fund to ensure it outperforms its benchmarks. Their responsibilities include forecasting global economic trends, assessing risk, conducting industry and competitor analyses, preparing fundamental company research reports, pitching investment ideas, tracking performance, executing back-office functions—and most importantly, having fun.

Luke Aaron

Portfolio Manager - Performance & Risk

Olatunde Sobowale

Portfolio Manager - Markets & External Relations

Elyes Ammar

Financials & Real Estate

Charles Castelly

Healthcare

Rohan Gaonkar

Information Technology

Md Azgor Hossain

Financials & Real Estate

Rohan Kanade

Consumer Staples

Aditya Khare

Communication Services

Tarun Khandelwal

Consumer Discretionary

Harsh Mishra

Information Technology

Mayowa Olaniyan

Energy & Utilities

Sravan Kumar Reddy Vemireddy

Industrials & Materials

Contact Us

The Mayer Fund welcomes media requests about the fund, its members, and our faculty advisor. We are also glad to answer questions from prospective students and general inquiries from interested parties. Please e-mail us directly at rhsmith-mayerfund@umd.edu.